Gold has long been a symbol of wealth and a reliable store of value. Its price has shown a consistent upward trend over the decades, making it a favored asset among investors. This article delves into the factors driving the perennial increase in gold prices, exploring historical contexts, economic principles, and future prospects.

Historical Context of Gold Prices

Ancient Times to Modern Era

Gold has been valued since ancient civilizations for its rarity, durability, and beauty. Early economies used gold as a form of currency and a symbol of status. Throughout history, gold maintained its allure and continued to be a standard for trade and wealth.

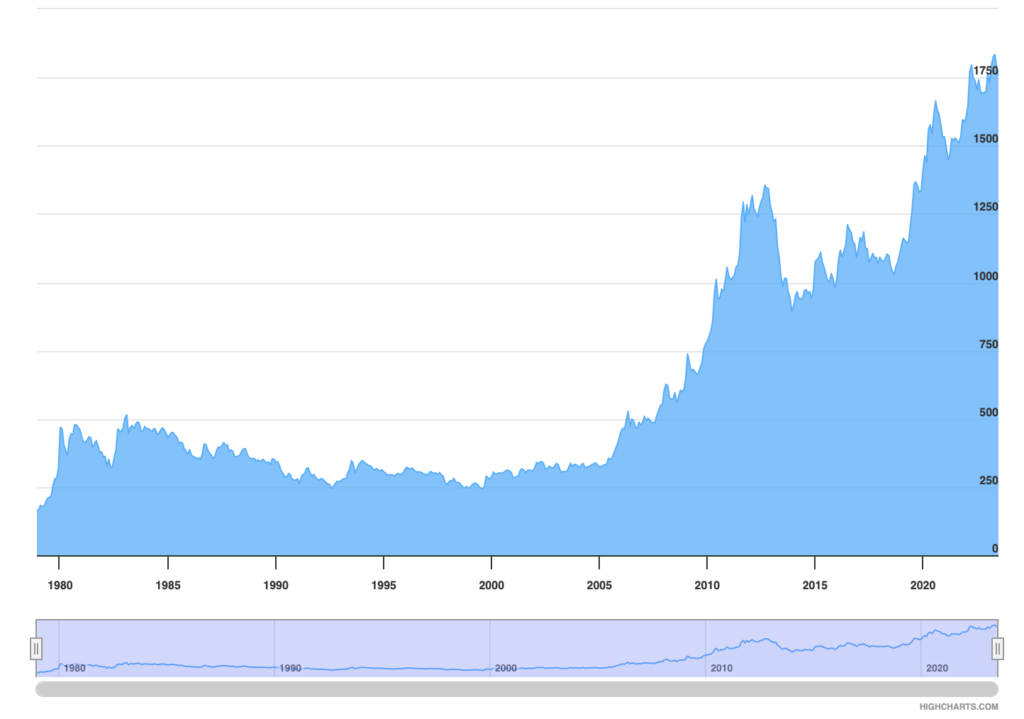

In the modern era, especially after the abandonment of the gold standard in the early 1970s, gold prices began to float freely. The shift allowed market forces to dictate gold prices, leading to increased volatility but also a significant long-term upward trend.

BUY GOLD WITH BITCOIN IN OUR STORE CLICK HERE

Post-Gold Standard Era

The end of the Bretton Woods system in 1971 marked a pivotal moment for gold prices. President Nixon’s decision to suspend the dollar’s convertibility into gold led to the metal’s price being set by the open market. The immediate aftermath saw a dramatic increase in gold prices, reflecting the market’s adjustment to the new economic reality.

Economic Factors Influencing Gold Prices

Inflation and Currency Devaluation

Gold is often viewed as a hedge against inflation and currency devaluation. When the value of fiat currencies decreases due to inflation, the price of gold typically rises. This inverse relationship is a key reason why gold prices trend upward during periods of high inflation or economic instability.

For instance, during the late 1970s, the United States experienced significant inflation, leading to a surge in gold prices. The metal hit a record high of $850 per ounce in January 1980, equivalent to over $2,500 per ounce in today’s dollars when adjusted for inflation.

Geopolitical Uncertainty

Political instability and geopolitical tensions also drive up gold prices. During times of crisis, such as wars or political upheavals, investors flock to gold as a safe haven asset. The metal’s price tends to spike during these periods, reflecting its status as a store of value in uncertain times.

The 2008 financial crisis is a prime example. The global economic meltdown led to a massive increase in gold prices as investors sought refuge from volatile stock markets and depreciating currencies. Gold reached over $1,900 per ounce in 2011, a significant increase from its pre-crisis levels.

Central Bank Policies

Monetary policies implemented by central banks significantly influence gold prices. Actions such as interest rate cuts, quantitative easing, and changes in reserve requirements can lead to fluctuations in the value of fiat currencies, thereby impacting gold prices.

For example, the Federal Reserve’s policies during the COVID-19 pandemic, which included substantial monetary easing and near-zero interest rates, contributed to gold reaching an all-time high of over $2,000 per ounce in August 2020.

Supply and Demand Dynamics

Mining Production and Costs

The supply of gold is largely influenced by mining production. While gold mining continues to expand, the discovery of new reserves has slowed, leading to higher production costs. This scarcity and the increased cost of extraction contribute to the rising price of gold.

Major gold producers like China, Australia, and Russia have maintained significant outputs, but the increasing difficulty and expense of mining new deposits play a role in driving prices upward. Additionally, environmental regulations and social responsibility concerns add to production costs, further influencing the market.

Investment Demand

Investment demand for gold, driven by private investors, institutions, and central banks, is a crucial factor in its price dynamics. Exchange-traded funds (ETFs) backed by physical gold have made investing in gold more accessible, thereby increasing demand.

Central banks, particularly in emerging markets, have also been accumulating gold reserves to diversify their holdings and reduce dependence on the US dollar. This trend has added a significant demand component to the market, supporting higher prices.

Jewelry and Industrial Demand

While investment demand plays a significant role, the demand for gold in jewelry and industry cannot be overlooked. Jewelry consumption, particularly in countries like India and China, remains a major driver of gold demand. Cultural practices and rising incomes in these regions support continuous demand for gold ornaments.

In industry, gold’s unique properties, such as its conductivity and resistance to corrosion, make it valuable in electronics and other high-tech applications. Although industrial demand is a smaller component compared to jewelry and investment, it adds to the overall demand for gold.

The Role of Speculation and Market Sentiment

Speculative Trading

Gold markets are heavily influenced by speculative trading. Traders and investors often buy and sell gold futures and options based on anticipated market movements. This speculative activity can lead to short-term volatility but often supports a long-term upward trend as more investors bet on gold as a safe haven asset.

Market Sentiment

Market sentiment, influenced by economic data, geopolitical events, and financial news, plays a significant role in gold price movements. Positive sentiment towards gold can drive prices higher as investors seek security in uncertain times. Conversely, negative sentiment can lead to temporary declines, although the long-term trend remains upward.

Technological Advancements and Gold Investment

Digital Gold

The advent of digital gold platforms has revolutionized gold investment. These platforms allow investors to buy, sell, and hold fractional amounts of physical gold, making the metal more accessible to a broader audience. This increased accessibility has bolstered demand, contributing to rising prices.

Blockchain and Gold

Blockchain technology has also made inroads into the gold market. Blockchain’s ability to provide transparency and security in transactions has led to the creation of gold-backed cryptocurrencies and digital tokens. These innovations have the potential to further increase demand for gold by integrating it into the digital economy.

The Future of Gold Prices

Economic Uncertainty and Inflation

Looking ahead, the price of gold is likely to continue its upward trend, driven by ongoing economic uncertainty and potential inflationary pressures. As governments and central banks navigate post-pandemic recovery, policies that affect currency values and economic stability will remain crucial determinants of gold prices.

Geopolitical Risks

Geopolitical risks, including trade tensions, conflicts, and political instability, will continue to drive demand for gold as a safe haven asset. The unpredictable nature of global politics ensures that gold will remain a valuable hedge against such risks.

Technological and Industrial Demand

Technological advancements and increasing industrial applications for gold will also support its price. As technology evolves and new uses for gold are discovered, industrial demand is likely to grow, adding another layer of support for rising prices.

The price of gold has been on an upward trajectory for decades, driven by a complex interplay of economic, geopolitical, and market factors. From its historical role as a symbol of wealth to its modern status as a hedge against inflation and uncertainty, gold continues to attract investors seeking stability and security.

As we move forward, the factors that have historically driven gold prices upward—economic uncertainty, inflation, geopolitical risks, and technological advancements—are likely to persist. This enduring demand, coupled with the challenges of increasing supply, suggests that gold will remain a valuable and sought-after asset in the years to come. Whether through traditional investment or emerging digital platforms, gold’s allure is poised to continue its rise, reflecting its timeless appeal as a store of value.