Why Buying Gold with Bitcoin is a Wise Investment

In the dynamic world of finance, two assets have consistently garnered attention for their stability and potential for growth: gold and Bitcoin. Gold, with its millennia-long history as a store of value, and Bitcoin, the pioneering digital currency, represent two ends of the financial spectrum—traditional and modern. The intersection of these two assets presents a unique investment strategy: buying gold with Bitcoin. This post delves into the compelling reasons why purchasing gold with Bitcoin is a wise investment choice, exploring the synergies between these two assets and the advantages of such a strategy.

The Allure of Gold

Gold has been revered for centuries for its intrinsic value and beauty. It has served as a currency, a symbol of wealth, and a safe haven during economic turbulence. Here are some key reasons why gold remains an attractive investment:

1. Store of Value

Gold’s primary appeal lies in its ability to preserve value over time. Unlike fiat currencies, which can be subject to inflation and devaluation, gold’s value remains relatively stable. This characteristic makes it a reliable hedge against economic uncertainty and currency fluctuations.

2. Safe Haven Asset

During periods of financial instability, investors flock to gold as a safe haven. Whether it’s economic recessions, geopolitical tensions, or market volatility, gold has historically provided a secure refuge for preserving wealth.

3. Diversification

Gold is an excellent asset for diversification. Its price movements often have a low or negative correlation with other asset classes like stocks and bonds. Including gold in a portfolio can reduce overall risk and enhance returns over time.

4. Liquidity

Gold is a highly liquid asset. It can be easily bought and sold in various forms, including bullion, coins, and ETFs, on numerous markets worldwide. This liquidity ensures that investors can convert their gold holdings into cash quickly when needed.

BUY GOLD WITH BITCOIN IN OUR STORE CLICK HERE

The Rise of Bitcoin

Bitcoin, introduced in 2009 by an anonymous entity known as Satoshi Nakamoto, has revolutionized the financial landscape. As the first decentralized digital currency, Bitcoin offers a new paradigm of monetary value and transactions. Here are some reasons why Bitcoin has gained prominence as an investment:

1. Decentralization

Bitcoin operates on a decentralized network called the blockchain, which eliminates the need for intermediaries like banks. This decentralization ensures that transactions are secure, transparent, and immutable.

2. Limited Supply

Bitcoin has a finite supply of 21 million coins, making it a deflationary asset. This scarcity is akin to gold, driving its value higher as demand increases over time.

3. Digital Gold

Bitcoin is often referred to as “digital gold” due to its similarities with the precious metal. Like gold, Bitcoin is seen as a store of value and a hedge against inflation. Its digital nature, however, offers added advantages in terms of ease of storage and transfer.

4. High Potential for Returns

Bitcoin’s price has experienced significant volatility, but it has also provided substantial returns for early investors. As adoption increases and the cryptocurrency ecosystem matures, Bitcoin’s value proposition continues to strengthen.

5. Global Accessibility

Bitcoin is accessible to anyone with an internet connection, making it a truly global currency. This accessibility allows for cross-border transactions without the need for intermediaries, reducing costs and increasing efficiency.

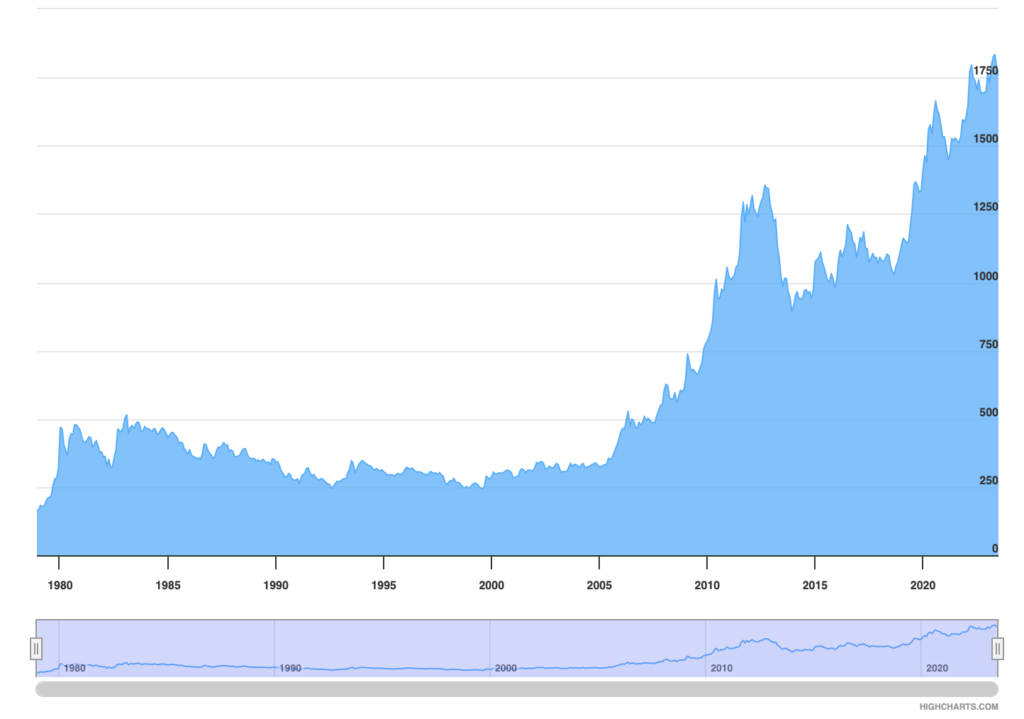

GOLD VALUE RISE CHART

Why Buy Gold with Bitcoin?

Combining the strengths of gold and Bitcoin can be a strategic investment move. Here are several compelling reasons why purchasing gold with Bitcoin is a wise decision:

1. Diversification of Digital Wealth

Investors who have accumulated significant wealth in Bitcoin can diversify their digital holdings by converting a portion into gold. This diversification can help mitigate the risks associated with Bitcoin’s price volatility while preserving the value of the investment in a stable asset like gold.

2. Hedging Against Volatility

Bitcoin’s price can be highly volatile, experiencing sharp fluctuations within short periods. Converting Bitcoin into gold provides a hedge against this volatility, ensuring that a portion of the investment remains stable and secure.

3. Security and Tangibility

While Bitcoin is a digital asset stored in wallets and protected by cryptographic keys, gold is a tangible asset that can be physically held. This tangibility offers an added layer of security and peace of mind for investors who value physical assets.

4. Combining Traditional and Modern Finance

Buying gold with Bitcoin represents the convergence of traditional and modern finance. It allows investors to leverage the strengths of both asset classes—gold’s stability and Bitcoin’s growth potential—creating a balanced and robust investment portfolio.

5. Tax Efficiency

In some jurisdictions, converting Bitcoin directly into fiat currency can trigger capital gains taxes. By purchasing gold with Bitcoin, investors may be able to defer or reduce tax liabilities, depending on local tax laws and regulations.

6. Ease of Transaction

Several platforms and services now facilitate the direct purchase of gold using Bitcoin. These platforms offer seamless and efficient transactions, enabling investors to easily convert their Bitcoin into gold without the need for multiple intermediaries.

7. Future-Proofing Investments

As the financial landscape evolves, digital currencies and traditional assets will likely continue to coexist. By investing in both Bitcoin and gold, investors can future-proof their portfolios, ensuring they are well-positioned to navigate the changing economic environment.